Good PMI primer: What is private financial insurance coverage?

Usually, a downpayment out-of 20% are you’ll need for traditional home loans, that has personal loan direct deposit been will a monstrous challenge to purchasing a home. Trying to save yourself an excellent $50,100 down payment to have an effective $250,one hundred thousand home is no small accomplishment!

Today, it is not uncommon to obtain conventional fund which have step three% otherwise 5% down payment criteria compliment of things titled PMI, or private financial insurance coverage. PMI is actually insurance rates that is covered from the citizen and you may grows their month-to-month homeloan payment. Their objective should be to manage the financial institution whether your debtor becomes not able to spend, given that lender is at greater risk when designing lenders that have low down costs.

PMI Masters

- Support somebody feel residents prior to before he has good 20% advance payment

- Normally necessary simply for the first an element of the loan

- An easy task to spend as an element of a month-to-month mortgage percentage

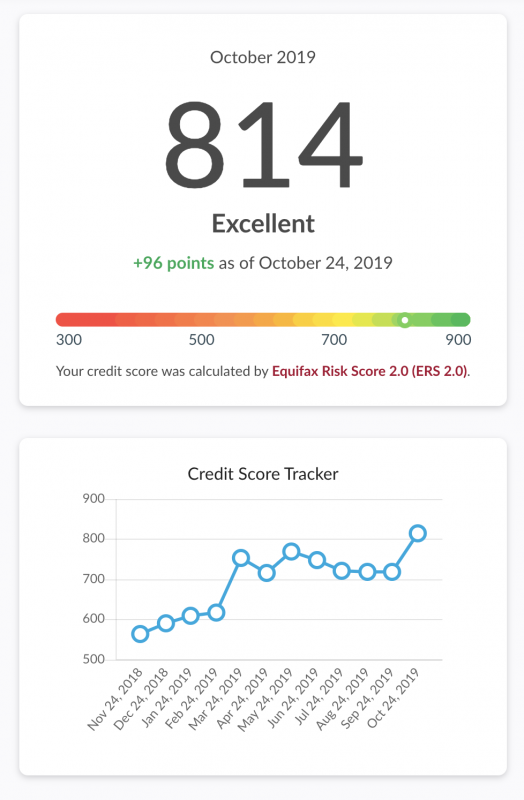

- Higher credit ratings and/or off costs can indicate all the way down PMI will cost you

PMI Disadvantages

- Increases the month-to-month financial fee into very early section of the loan

- The expense of PMI may differ some other varying so you’re able to cause of when selecting your lender

- Down fico scores and you will/otherwise down money often means highest PMI will cost you

Just how PMI Performs

To own old-fashioned funds, PMI is normally repaid as part of your month-to-month financial payment. Given that a variety of insurance policies, brand new PMI costs is referred to as a premium, in fact it is computed on the a percentage base. Your own financial tend to divulge the new PMI percentage of your loan fee prior to signing to shut your home loan. PMI generally actually taken care of the life span of the financing only the initial phases something we shall talk about subsequent from the Deleting PMI area below.

The typical yearly cost of PMI ranges away from 0.55% in order to 2.25% of completely new loan amount, predicated on a recent study because of the Metropolitan Institute. Where for the reason that range do you ever belongings? One to relies on your specific mortgage terms and conditions, your credit score, plus lender. A higher downpayment and/or higher credit score will be web your a diminished PMI costs. And sure, your own PMI speed can differ with respect to the lender you choose, so prefer a loan provider having your absolute best welfare at heart! (Solarity, for-instance, has actually discussed faster PMI advanced for the professionals.)

What exactly often 0.55% to help you dos.25% imply on the monthly payment? Let’s say you will be making a 5% advance payment on property charging $289,900 (brand new average checklist cost of You.S. homes since predicated on Zillow). If you’re expenses 1% for PMI, you to compatible on $230 four weeks, or $2,760 set in your property mortgage payments during the period of a year.

Financial insurance to have federally guaranteed financing, such as FHA or USDA loans, operates a small in another way from PMI getting antique mortgage loans. Va fund don’t require mortgage insurance policies but can tend to be a good financing payment.

PMI against. Preserving to own a beneficial 20% Deposit

Based on your role and you can economic presumptions, purchasing earlier which have PMI may set you ahead of in which you will be for those who proceeded to help you rent if you’re preserving for the 20% deposit to eliminate PMI. As with any monetary data, your unique condition plus presumptions are fundamental. Listed below are some rates to adopt:

- Home prices have raised step 3.6% a year since the 1991 (at the time of 5/2019, predicated on a recent Federal Housing Financing Agency declaration).

- It could take 5 years to keep an additional fifteen% deposit necessary to avoid PMI (for instance, 15% of the median home price listed above could well be only more than $43,000).

Do not let such numbers daunt your! For many people, their studies urban centers them rather prior to the game after four many years of PMI repayments. Simply speaking, everybody’s condition varies. It is advisable that you keep in mind the potential great things about to find before, and then consider people advantages against the concrete price of PMI payments.

Deleting PMI

Discover information and requirements (you need to be latest on the payments, as an instance), and you will select an effective post on this type of arrangements with the your website of one’s User Financial Safeguards Bureau.

The lender I termination available options to you, otherwise it We fate within their very own give, and you can re-finance the loans in an effort to clean out PMI requirements before, particularly when:

If a person otherwise both of these products provides your residence mortgage amount less than 80% of your (new) property value your residence, PMI may not be needed in your the loan. It is critical to keep interest levels at heart in terms of refinancing and to reason behind the cost of new re-finance (they might be fundamentally perhaps not free), if the mathematics ends up and your home appraises to possess what you think it has to, this can be good selection for removing PMI.

Delivering all of it Together

Individual home loan insurance coverage adds to your own monthly mortgage costs, however it makes it possible to get the legs regarding the homeownership home. There is a large number of factors to take into consideration, but a beneficial lender would be willing to walk you through your options and discover what is actually most effective for you. In fact, that is what Solarity really does ideal!

Slamming for the door to help you homeownership?

When you have issues or will be ready to apply for a great financial, the professional Mortgage Books find their name in all honesty. It like permitting someone build a house their home.