The amount of new Scholar As well as mortgage eligibility would-be incorporated in the latest school funding prize alerts

Also Promissory Notice: All of the Scholar student individuals will be required to help you signal a master Promissory Mention (MPN). Latest statutes allow a scholar pupil to accomplish you to promissory mention (Grasp Promissory Notice) and is utilized for future Plus financing borrowed. Brand new Along with MPN will not inform you loan number because it can act as a graduate student’s promissory notice for the future. Take note that each degree of And additionally financing tend to results for the a credit rating query.

Graduate individuals will get its And Revelation Declaration for every single this new loan lent. The latest disclosure statements give information regarding the amount of money lent, the loan months, while the forecast disbursement times. Graduate college students will be take care of the comments due to their facts.

Once an exclusive financing has been authoritative additionally the scholar wants so you can borrow money as well as the matter specialized, new student have to over a special application for the loan to your lender of its alternatives

Graduate pupils ount of its mortgage(s) by doing a grants or scholarships Transform Means Disappear and you Hudson loans places can submitting they to help you Beginner Financial Functions. To get rid of taking on attract costs and you can financing charge, funds must be returned inside 120 days of disbursement. Shortly after an advantage Loan might have been smaller or terminated, a different Educational funding Raise mode have to be done and you will a beneficial new loan canned making sure that us to help the matter of the complete Along with Loan. When the 3 months provides passed since the history credit score assessment, a different sort of credit check will be held.

Disbursement Process: The latest Graduate In addition to is often payable in 2 disbursements, one-half of the total inside the for each and every session. Financing fund can not be credited towards student’s account up to accepted by the bank, as well as the pupil has enrolled in sufficient credit circumstances. All of the scholar people at the University have to be enlisted at the very least half time (no less than six borrowing from the bank instances) during the a diploma-seeking program. Wants most Graduate And financing might be canned once the a beneficial separate financing.

The newest financial aid prize means the entire amount borrowed of your Graduate Including provided. The true number paid was shorter due to origination charge.

Regarding an overhead-honor, you to definitely otherwise each of the loan disbursements tends to be reduced or terminated. Likewise, when the tuition charge was shorter due to a general change in registration, departmental or low-college or university prizes, that or each of the fresh new disbursements must getting adjusted or canceled.

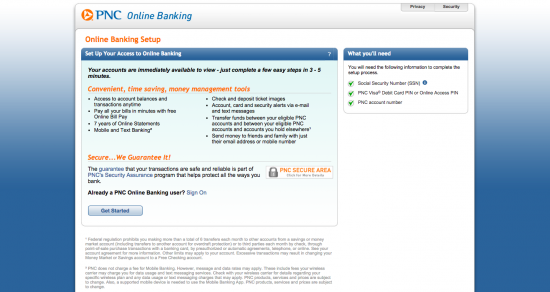

Repayment: Within the Graduate And program, installment must initiate in this two months immediately after full disbursement of one’s loan. There’s no elegance several months towards Graduate Including loan. Deferments may be readily available. For additional information about deferments, excite get hold of your mortgage servicer. You’ll find the loan servicer of the log in in order to with your own Federeal FSA ID.

Forbearance

Of several individual credit organizations promote borrowing from the bank-created mortgage programs in order to students. College students will be cautiously think about the rates, loan charge, and you may terms of the application form before you make a choice. Most associations possess an on-line application followed closely by a credit assessment. As school are informed, the institution will approve the loan amount. The newest student probably will be necessary to complete possibly an in-line otherwise papers promissory mention. Very lenders requires a card-worthwhile co-signer that is an effective Us resident. Less than is a few information to take on before selecting a personal financing. It’s important to observe that we can not award a personal mortgage up until the college student provides often approved or refused all other honors that will be part of the school funding prize.

Understand Your Get-Really personal finance are derived from the newest creditworthiness of your own borrower and/otherwise co-signer. Pupils would like to know the credit history. The better the credit get, the higher the rate. Pupils will get its credit score here could have been developed by the 3 crediting bureaus and you will allows youngsters discover a copy of the free credit file in order to buy a beneficial content of the credit rating.